The coronavirus pandemic and containment measures have plunged the global economy into deep contraction. Home sales are expected to increase another 6.6% and home prices to rise another 2.9% on top of 2021 highs. Based on the latest research on Active Capital 2021 from Knight Frank Asia Pacific, it is predicted that cross-border property investment will hit a record in 2022.

A gradual uptick in mortgage rates will make affordability a top consideration for home buyers, especially the 45 million Millennials aged 26 to 35 who are at prime first-time home buyer age. Demand from these young households will keep the market competitive and fast-paced despite a small uptick in housing inventory as builders continue to ramp up production, increasing single-family starts by 5% in 2022.

With the overall economic recovery, the property sector could grow 6.6 percent compared to 2021. This is good news for the property because it is long-term. Because when the property goes down it takes a long time, but when it goes up this sector will continue to rise.

A new year is coming soon. However, some resolutions may not be met. One of them is buying a house, either for residential use or buying a second home for investment. Then, is this resolution still realistic to pursue? You know, 2022 is just a matter of days. The process of buying a house can be hard to navigate, but these essential tips will help you make the best decisions. Here are tips for buying a house at the end of the year.

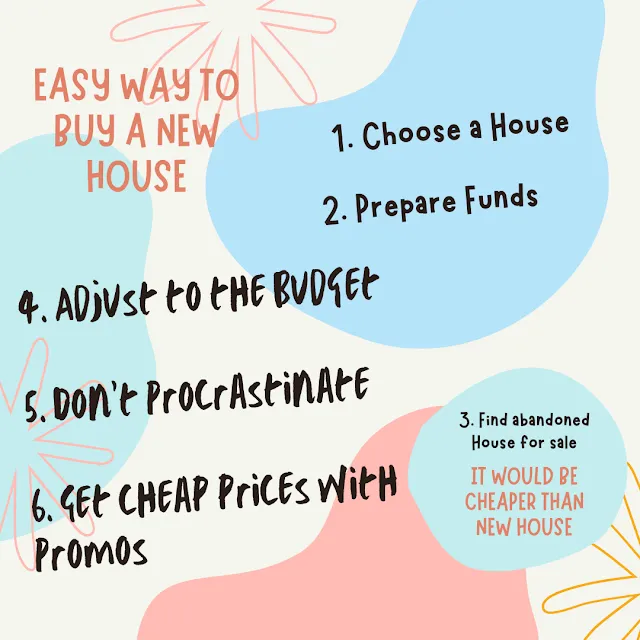

Easy Ways to Buy A New House in 2022

1. Choose a House

Property observer, as well as Senior Associate Director of Research Colliers International, said the main thing, of course, was to first select the house to be purchased. Because it's nearing the end of the year, make sure the house you want to buy is already on your list.

However, keep in mind that you should not be careless in determining the house you want to buy. You need to make sure the house fits your needs. Especially for those who want to invest, it is necessary to take into account whether this house has an investment value or not.

2. Prepare Funds

If the matter of choosing a house is solid, then next you need to think about funds. According to CFP Learning & Development Manager Advisors, buying a house at the end of the year is the same as buying a house in general.

In essence, you need to prepare initial funds. Starting from a down payment, notary administration fees, and taxes, to the first installment. Usually, these expenses must be met. You could calculate your mortgage qualification based on your income in the calculator affordibility.

3. Find Abandoned Homes for Sale

Do you like watching Fixer Upper or Property Brothers on HGTV? Time for you to glance at the old house. If you know old house prices, home renovations, and others, don't hesitate to buy an old house.

You can take into account the price of an old house that is not well maintained and the cost of renovation. If the foundation of the house is still in good condition, but the house is old, you can change the interior design. The exterior appearance of the house may be old school, but the interior of the house instead features a modern minimalist interior design.

4. Adjust to the Budget

Buying the first house doesn't have to be luxurious, but it would be better if the house you want to buy is under the budget you have, especially when someone chooses to pay for the house. Don't force yourself to buy a house beyond your financial capacity, because later it will have an impact on burdensome installments.

Just because you've been approved for a $300,000 mortgage doesn't mean you should buy a $300,000 home. You'll need to consider expenses for closing costs, taxes, insurance, repairs, and monthly bills. Or you can use a mortgage calculator to calculate how much you can use so you don't exceed the available budget.

5. Don't Procrastinate

The right time to buy a house is now. According to him, house prices go up every year and don't wait to have savings to buy a house.

When asked when is the best time to buy a house? Buy it today because house prices continue to increase while savings are losing out quickly. So don't ever think about saving first before buying a house, buying a house while saving.

If you want to speed up your home installments, you can calculate the monthly fees you can afford to make it easier to pay off the installments. And after that, you can save as much as you want. Use the Calculator to calculate how quickly you can pay off your mortgage.

6. Get Cheap Prices with Promos

You can take advantage of promos from housing developers. For example, free booking fees, low-interest rates, discounts with a certain down payment, to house price discounts.

Conclusion

Property can be a valuable long-term investment. But as with any investment, market research is best done beforehand. In the right environment, the value of the investment will grow rapidly. There are even people who sell the unit before the construction of the apartment is complete. Some choose to rent out their units so that they can get their return on investment faster.

Where can you buy a new home? What about the new home buying tips you just read? There are many projects for sale in Indonesia. Many large developers have building stock ready for occupancy. If you are interested in buying a new home and want to move, better move now. Happy house hunting.

0Komentar

Terima kasih sudah berkunjung. Silakan tinggalkan komentar dengan bahasa yang baik ya. Untuk komentar dimoderasi ya.